Higher Rate SDLT Refund – Claiming It When You Sell Your Main Residence Within 3 Years

December 17, 2025

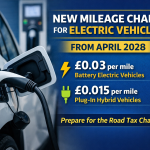

New Mileage Charge for Electric Vehicles from April 2028

December 22, 2025Mileage claims are one of the most common expense claims made by sole traders, company directors, and small business owners. They are also one of the most frequently queried by HMRC. We are often asked what evidence is required if HMRC decide to review or challenge a mileage claim.

The short answer is that HMRC do not accept estimates or rough calculations. They expect a clear, detailed mileage record that supports every claim made.

Why HMRC Scrutinise Mileage Claims

Mileage claims reduce taxable profits, so HMRC will often check that claims are genuine and wholly for business purposes. Claims that are round numbers, unusually high, or unsupported by records are more likely to be queried during a compliance check or enquiry.

If adequate records are not available, HMRC can disallow the mileage claim and require the tax to be repaid, often with interest and potential penalties.

What HMRC Expect to See in a Mileage Log

If HMRC ask for evidence, they will expect a full mileage log. This should include all of the following details:

The date each journey was undertaken

The start and end destinations of the journey, including postcodes where possible

The distance travelled for each trip

The business reason for the journey, for example visiting a client, attending a site visit, or travelling to a temporary workplace

These details should be recorded for every business journey. Simply stating total annual mileage or using estimates based on fuel costs is not sufficient.

Business vs Personal Travel

Only business travel is allowable for mileage claims. Travel between home and a permanent workplace is treated as ordinary commuting and is not allowable. Your mileage log should clearly demonstrate that the journeys claimed were for business purposes and not personal use.

Where a journey includes both business and personal elements, only the business portion should be claimed.

How to Keep Mileage Records

Mileage records can be kept in a spreadsheet, a written logbook, or using a recognised mileage tracking app. The format is less important than the accuracy and completeness of the information recorded.

Records should ideally be updated at the time of travel or shortly afterwards. Recreating mileage logs months or years later is risky and often leads to errors that HMRC may challenge.

HMRC generally expect records to be retained for at least six years.

Flat Rate vs Actual Costs

Most sole traders and directors use HMRC’s approved mileage rates rather than claiming actual vehicle running costs. Even when using the approved rates, a mileage log is still required to justify the claim.

Using the approved rates does not remove the need for proper records.

Common Mistakes We See

Some of the most common issues we see include:

Claiming mileage without any supporting log

Using estimated or rounded mileage figures

Missing business reasons for journeys

Including commuting or personal travel

Failing to keep records for earlier tax years

Any of these can result in claims being reduced or rejected by HMRC.

Need Help or a Mileage Template?

If you are unsure whether your mileage records are HMRC compliant, or you want help setting up a simple mileage log that works for your business, we can help.

Call 0161 710 1901

Email Tax@TaxesDoneRight.co.uk

Visit www.taxesdoneright.co.uk

Keeping proper mileage records now can save a lot of stress, time, and tax later.