Mileage Claims – What Records HMRC Expect If They Query Your Claim

December 18, 2025

S455 Charge on Director’s Loan Accounts to Increase in Line with Higher Rate Dividend Tax

December 26, 2025For years, electric vehicles (EVs) have enjoyed significant tax advantages, including exemption from road tax and fuel duty. That is now set to change.

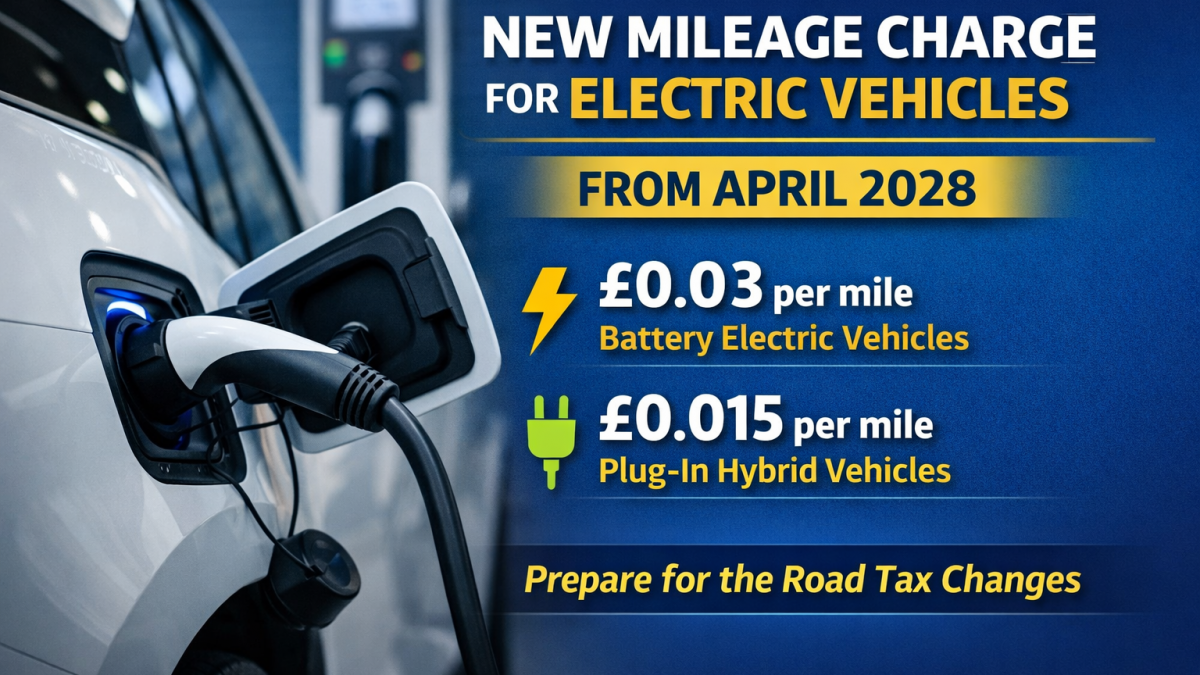

From April 2028, the UK government will introduce a mileage-based road charge for electric and plug-in hybrid vehicles. This marks a major shift in how motoring is taxed and reflects the government’s response to falling fuel duty revenues as petrol and diesel usage declines.

What Is Changing?

Instead of relying on fuel duty, the government will charge motorists based on miles driven.

The proposed rates are:

- £0.03 per mile for battery electric vehicles (BEVs)

- £0.015 per mile for plug-in hybrid vehicles (PHEVs)

This effectively ends the long-standing “zero road tax” advantage for electric vehicles.

Why Is This Being Introduced?

Fuel duty currently raises tens of billions of pounds each year. As more drivers switch to electric vehicles, that revenue is falling rapidly.

The mileage-based charge is designed to:

- Replace lost fuel duty income

- Create a fairer system where all motorists contribute

- Ensure long-term funding for road maintenance and infrastructure

This change is not about discouraging electric vehicles, but about modernising the tax system to reflect how people now drive.

Who Will Be Affected?

This change will affect:

- Private EV owners

- Company car drivers

- Landlords and property investors using EVs for business travel

- Self-employed individuals and directors using electric vehicles

If you currently rely on the low running costs of an EV as part of your tax planning, this will need to be reviewed ahead of 2028.

What About Business Mileage and Tax Relief?

Mileage claims and expense treatment will become more important than ever.

Key points to consider:

- Businesses may need to track mileage more accurately

- Company car tax planning may need revisiting

- Electric vehicle cost comparisons should include future mileage charges

- Record-keeping will be critical if HMRC scrutiny increases

For company directors and landlords, this could influence whether it remains tax-efficient to run an EV through a limited company or personally.

Is This the End of EV Tax Advantages?

Not entirely.

Electric vehicles still benefit from:

- Lower benefit-in-kind rates compared to petrol and diesel

- Reduced running and maintenance costs

- Environmental incentives and cleaner-air benefits

However, the gap between electric and traditional vehicles is narrowing, and future planning needs to reflect that reality.

What Should You Do Now?

Although the change does not start until April 2028, early planning is sensible.

You should:

- Review long-term vehicle plans

- Factor mileage charges into cost projections

- Ensure mileage records are robust

- Seek advice before committing to new EV purchases for business use

Final Thoughts

The introduction of mileage-based charging signals a fundamental change in how motoring is taxed in the UK. Electric vehicles are moving from being a tax-free alternative to being part of the mainstream tax system.

Understanding these changes early allows you to plan smarter, avoid surprises, and make informed financial decisions.

If you would like tailored advice on EVs, mileage claims, company cars, or tax-efficient vehicle planning, speak to a specialist accountant before April 2028 approaches.