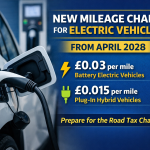

New Mileage Charge for Electric Vehicles from April 2028

December 22, 2025

Should Landlords Still Own Property Personally in 2026?

December 29, 2025The cost of extracting money from a limited company without planning is rising again. From April 2026, the Section 455 (s455) tax charge on overdrawn Director’s Loan Accounts (DLAs) is set to increase in line with the higher rate dividend tax.

This change directly impacts directors who borrow money from their company instead of paying salary or dividends — a strategy that is already closely monitored by HMRC.

In this blog, we explain what s455 is, what is changing, why it matters, and how directors can plan ahead.

What Is a Director’s Loan Account (DLA)?

A Director’s Loan Account records money moving between a director and their company outside of salary, dividends, or expenses.

A DLA becomes overdrawn when:

- A director takes money from the company

- The amount is not repaid

- It is not voted as a dividend

- It is not processed as salary

Overdrawn DLAs are legal, but they come with significant tax consequences.

What Is the Section 455 (s455) Tax Charge?

Section 455 is a temporary corporation tax charge imposed when:

- A director or shareholder owes money to the company

- The loan is still outstanding 9 months and 1 day after the company’s year-end

The purpose of s455 is to discourage directors from using company funds as a personal bank account.

Current s455 Rate (Up to April 2026)

Until now, the s455 charge has been set at:

- 33.75% of the outstanding loan balance

This rate was deliberately aligned with the higher rate dividend tax, preventing directors from avoiding dividend tax by taking loans instead.

What Is Changing?

From April 2026, the higher rate dividend tax is increasing, and the s455 charge will rise by the same margin.

➡️ Increase: 2 percentage points

➡️ New s455 rate: 35.75%

This means over one-third of the outstanding loan will be payable to HMRC if the DLA is not cleared on time.

Why Has the s455 Charge Increased?

HMRC’s reasoning is simple:

- Directors were using DLAs as a tax deferral tool

- Loans avoided immediate income tax or dividend tax

- Alignment ensures no tax advantage compared to dividends

The increase reinforces HMRC’s long-standing position that DLAs are not a tax-efficient extraction strategy.

Important Point: s455 Is Refundable — But Not Immediately

The s455 charge is not permanent, but:

- It is payable upfront by the company

- It is only refundable after the loan is repaid

- The refund is claimed 9 months after the end of the accounting period in which repayment occurs

This can result in:

- Significant cash-flow pressure

- Long delays before HMRC refunds the tax

Additional Tax Risks with Overdrawn DLAs

The s455 charge is not the only issue.

If the loan exceeds £10,000 at any point:

- A benefit-in-kind arises

- Personal tax may be due on the director

- Class 1A National Insurance may apply

If the loan is written off:

- It is taxed as income or dividends

- No s455 refund is available

Example: How the Increase Affects Directors

Loan balance: £50,000

Outstanding after 9 months

- Old s455 rate (33.75%): £16,875

- New s455 rate (35.75%): £17,875

➡️ Extra tax cost: £1,000

This is before considering any benefit-in-kind or personal tax exposure.

Smarter Alternatives to Director’s Loans

With higher s455 rates, directors should consider:

- Declaring dividends (with proper planning)

- Paying bonuses where appropriate

- Clearing DLAs before the deadline

- Using dividends to offset loan balances

- Structuring remuneration efficiently

Early planning can eliminate s455 entirely.

Key Takeaway

The increase in the s455 charge makes overdrawn Director’s Loan Accounts more expensive and riskier than ever.

What was once seen as a short-term cash solution is now a high-tax strategy with cash-flow consequences.

If you are using — or planning to use — a Director’s Loan Account, now is the time to review your position before the higher charge applies.

Need Help Reviewing Your Director’s Loan Account?

At Taxes Done Right, we help directors:

- Clear DLAs tax-efficiently

- Avoid s455 charges

- Plan dividends properly

- Stay compliant with HMRC

📞 Call: 0161 710 1901

📧 Email: Tax@TaxesDoneRight.co.uk

DM US:

🌐 Visit: www.taxesdoneright.co.uk