Selling Personal Items on eBay/Vinted. Don’t Panic About Tax!

December 10, 2025

The 2026 Tax Changes Landlords Need to Prepare For

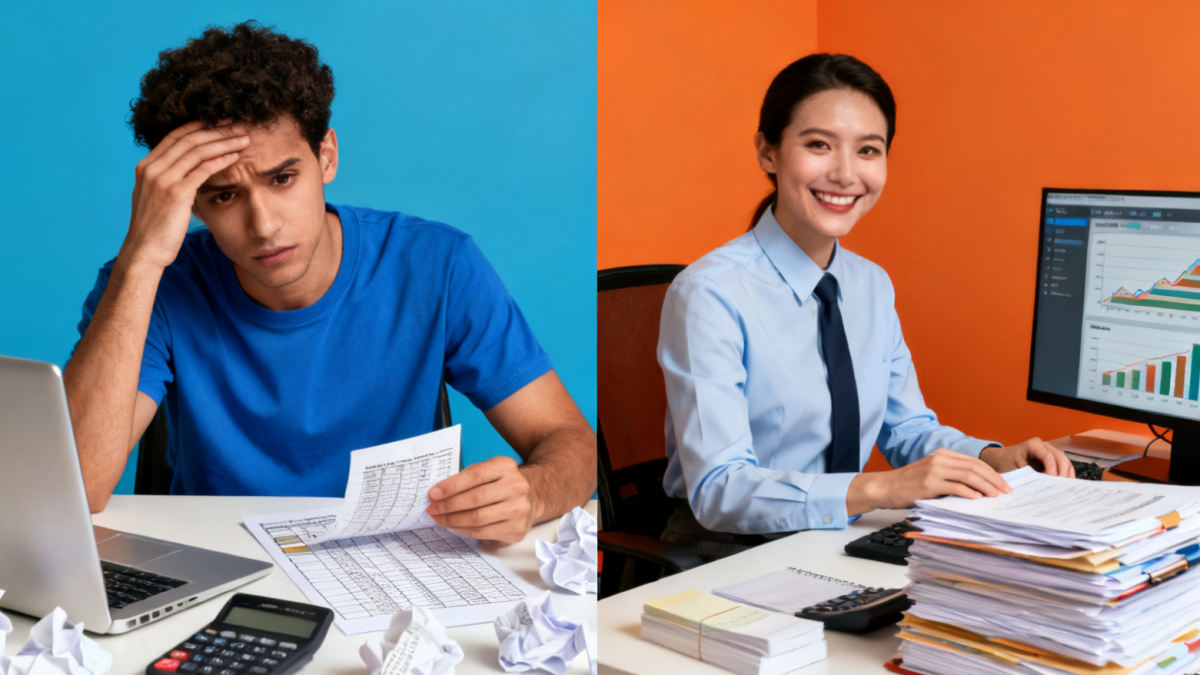

December 11, 2025Every year thousands of people try to save money by completing their tax return themselves. On the surface it seems simple. Put the numbers in the right boxes, press submit, and you’re done.

But the reality is very different. A tax return is not just data entry. It is a legal document. And the cost of getting it wrong can be far higher than the cost of hiring a professional accountant.

Many people only discover this when HMRC opens an enquiry, or when a new accountant reviews past returns and finds years of errors.

Why DIY Tax Returns Feel Easy (But Often Aren’t)

HMRC’s online system doesn’t check whether your return is accurate. If you enter a number that looks reasonable, the system accepts it. That leads many people to believe everything must be correct.

But accuracy is your responsibility, not HMRC’s. Mistakes stay hidden until something triggers a review.

This is where problems begin, especially for landlords, small business owners, side-hustlers, and anyone with income more complex than a basic salary.

Common DIY Mistakes That Cost People Money

1. Misunderstanding what can and can’t be claimed

People often guess what qualifies as an allowable expense. Some underclaim and pay more tax than necessary. Others overclaim and risk penalties.

2. Confusing repairs, improvements and capital allowances

Replacing a roof is different to repainting a room. Buying equipment is different to repairing it. Some costs qualify for capital allowances like AIA, some don’t.

One wrong classification can affect multiple tax years.

3. Missing reliefs completely

DIY filers often overlook:

- Capital gains allowances

- Property allowance or trading allowance

- Mortgage interest relief rules

- Loss relief and carry-forward rules

- Mileage vs actual cost claims

Missing a relief is the same as paying unnecessary tax.

4. Believing “HMRC hasn’t checked, so it must be fine”

This is a common myth. No investigation does not mean your return was accurate. HMRC enquiries can go back several years, and errors can quickly become expensive.

5. Incomplete or incorrect record-keeping

When HMRC asks for evidence, you must prove every figure. DIY returns often lack the paperwork needed to defend the numbers submitted.

What a Professional Accountant Actually Does

Many people think an accountant “just fills in the form”, but the real value is in the work you don’t see.

A good accountant:

- Reviews your situation to legally reduce your tax

- Checks every figure for compliance

- Identifies reliefs you didn’t know you could claim

- Calculates tax accurately across different income types

- Provides documentation and protection in case of enquiry

- Gives you peace of mind that your return is correct

You are not just paying for a submitted return. You are paying for accuracy, expertise and financial protection.

A Real Example We See All the Time

A taxpayer told us they had been filing their own return for 20 years and “never had a problem”.

We asked one simple question:

“How do you claim capital allowances?”

Their answer was: “You just put the figure in the box.”

Unfortunately, it’s not that simple. Some assets go into pools, some qualify for AIA, some qualify for FYA, and some get no allowances at all. They had been submitting incorrect claims for years without realising.

Mistakes like these aren’t obvious unless you know what to look for.

DIY vs Accountant: The Real Cost Difference

| DIY Tax Return | Professional Accountant |

|---|---|

| Seems cheaper at first | Saves money in the long run |

| High risk of errors | Accurate and fully compliant |

| Easy to miss reliefs | All reliefs correctly applied |

| No support if HMRC asks questions | Professional representation |

| Stressful | Peace of mind |

A return that looks right is not the same as a return that is right.

Is DIY Ever Suitable?

DIY can work when your situation is extremely simple. For example:

- You only have PAYE income

- No rental income

- No self-employment

- No capital gains

- No foreign income

But if your finances include anything more complex than that, a professional accountant is almost always the safer, cheaper and smarter choice.

Final Thoughts

Doing your own tax return can feel like a quick win, but the risks are real.

A small mistake today can become a large problem later.

A missed relief can cost you money every single year.

An inaccurate return can lead to penalties, interest and stress.

A professional accountant doesn’t just complete a form. They safeguard your finances, apply the right rules, and ensure everything is reported correctly.

When it comes to tax, what you don’t know can cost you.