What Triggers an HMRC Enquiry

January 22, 2026

What HMRC Considers “Trading” vs a Hobby for Self-Assessment

January 26, 2026Submitting your Self-Assessment tax return can feel like the finish line, but in reality it is only part of the process. Many taxpayers assume that once the return is filed, nothing else happens unless HMRC contacts them. In practice, there are several steps that take place behind the scenes, and understanding them can help you avoid confusion, delays, or unexpected issues.

HMRC Acknowledgement and Processing

Once you submit your Self-Assessment online, HMRC will issue an on-screen confirmation and usually send an email acknowledging receipt. This simply confirms that the return has been received, not that it has been checked or approved.

HMRC then processes the return using automated systems. Most returns are not manually reviewed at this stage. The information you submit is compared against data HMRC already holds, such as PAYE records, bank interest, dividends, property data, and information received from third parties.

Your Tax Calculation Becomes Final

After submission, HMRC treats the figures in your return as correct unless something triggers a review. The tax calculation shown in your Self-Assessment account becomes the amount legally due.

If you owe tax, payment is normally due by 31 January following the end of the tax year. If you are required to make Payments on Account, these will also be shown, with instalments due in January and July.

If you are due a refund, HMRC will begin repayment processing once the return has been fully processed.

Refunds and Repayments

If your return shows that you are due a tax refund, this does not always happen immediately. Repayments can take anywhere from a few days to several weeks.

Delays commonly occur where HMRC carries out security checks, where bank details have recently changed, or where the return includes higher-risk items such as property income, large expenses, or capital gains.

HMRC may ask you to verify your identity or confirm bank details before releasing the repayment.

Possible Amendments or Corrections by HMRC

HMRC has the power to correct obvious errors in a tax return. These are known as “HMRC corrections” and can include things like simple calculation errors or inconsistencies.

If HMRC makes a correction, they will notify you. You have the right to appeal if you disagree with the change.

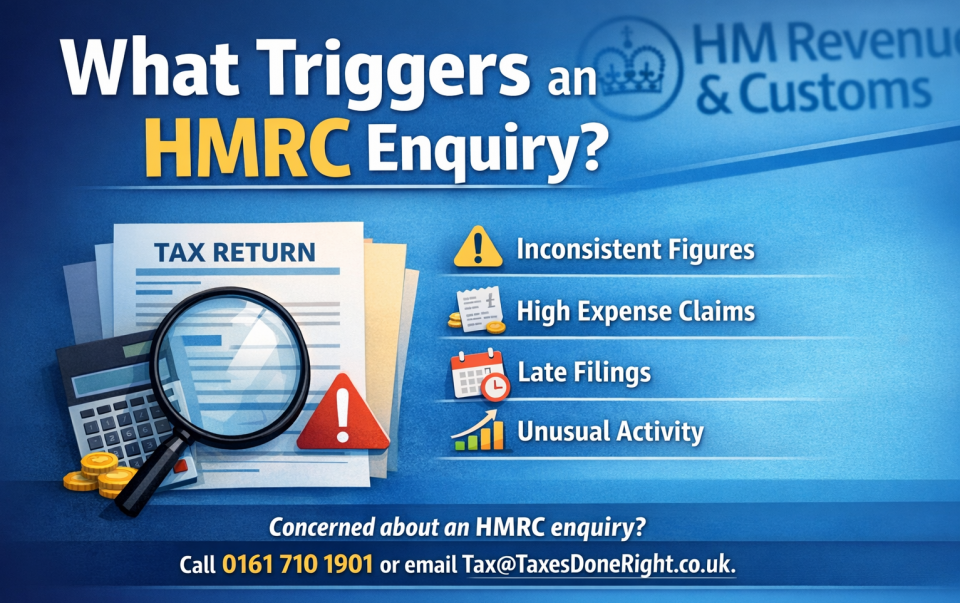

In addition, HMRC can open a compliance check or enquiry within certain time limits if they believe something is incorrect or incomplete.

Enquiries and Compliance Checks

Most Self-Assessment returns never lead to an enquiry. However, HMRC may open a check if the return does not match their data, appears unusual, or falls into a higher risk category.

An enquiry does not automatically mean you have done anything wrong. It is HMRC’s way of asking for clarification or evidence. Responding promptly and accurately is essential to avoid escalation.

Record Keeping After Submission

Even after your return is filed, you are legally required to keep your records. For most individuals, records must be kept for at least five years after the 31 January filing deadline.

This includes invoices, bank statements, expense receipts, dividend vouchers, and property records. HMRC can request these documents later if they open a review.

Amending Your Own Tax Return

If you realise you have made a mistake after submitting your Self-Assessment, you can amend the return. Online amendments are usually allowed up to 12 months after the filing deadline.

Correcting errors early can prevent penalties and interest building up later.

Ongoing Responsibilities

Submitting a return does not automatically remove you from Self-Assessment in future years. If HMRC expects you to file again, you will continue to receive notices to file until you are formally removed from the system.

If your circumstances change, such as stopping self-employment or no longer having untaxed income, this should be reviewed with HMRC to avoid unnecessary filing obligations.

Final Thoughts

Submitting your Self-Assessment is an important step, but it is not the end of the process. Understanding what happens afterwards helps you stay in control, respond quickly if HMRC contacts you, and avoid unnecessary stress.

If you are unsure about your tax position after submitting your return, or if HMRC has contacted you, Taxes Done Right advice can make a significant difference.