When Should You Register for Self‑Assessment?

January 20, 2026

What Triggers an HMRC Enquiry

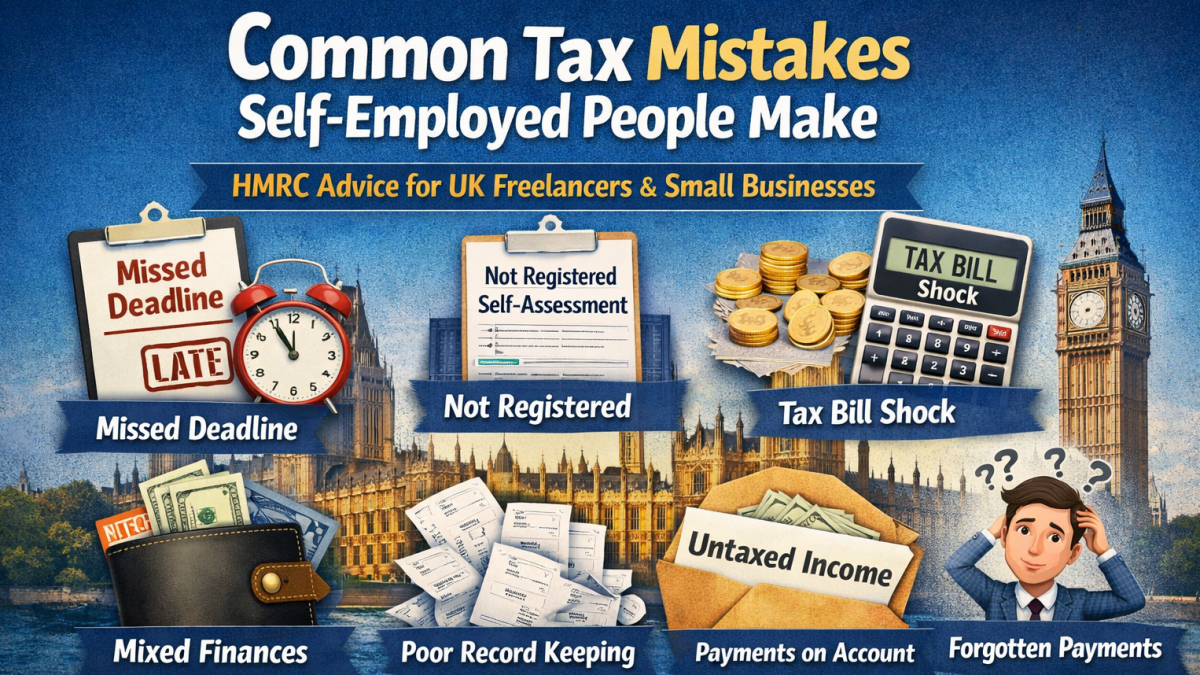

January 22, 2026Running your own business brings freedom and flexibility, but it also comes with tax responsibilities that are often misunderstood. Many self-employed people make the same tax mistakes every year, which can lead to unexpected bills, penalties, or HMRC enquiries.

Below are some of the most common tax mistakes made by self-employed individuals in the UK.

Failing to Register for Self-Assessment

One of the most frequent issues is not registering for Self-Assessment after starting self-employment. This includes people with small side incomes, freelance work, or online sales. Missing the registration deadline can result in penalties even before a tax return is submitted.

Underestimating the Tax Bill

Many self-employed individuals underestimate how much tax and National Insurance they will owe. Unlike PAYE employees, tax is not deducted automatically, which often leads to large, unexpected bills.

Mixing Personal and Business Finances

Using a single bank account for both personal and business spending is very common. This often leads to missing income, incorrect expense claims, and difficulties when preparing tax returns.

Claiming Incorrect or Ineligible Expenses

Some self-employed people accidentally claim expenses that are not allowable, while others miscalculate proportions for mixed-use costs such as home working, vehicles, or mobile phones. This can cause issues if HMRC reviews the return.

Poor Record Keeping

Lost receipts, missing invoices, and incomplete records are a regular problem. Inadequate documentation makes it difficult to support figures declared on a tax return and increases the risk of errors.

Forgetting Payments on Account

Payments on account catch many people by surprise. These advance payments can significantly increase the amount due in January and July, causing confusion and cashflow problems.

Missing Deadlines

Late submission of tax returns and late payment of tax are common mistakes. Even a single day late can trigger automatic penalties and interest.

Not Declaring All Income

Some self-employed individuals forget to declare income from secondary work, cash payments, or online platforms. HMRC increasingly receives data directly from banks and digital marketplaces, making omissions more visible.

Assuming an Accountant Will Fix Everything Automatically

A common misconception is that once an accountant is involved, all responsibility transfers to them. In reality, the taxpayer remains legally responsible for the accuracy of their return.

Not Understanding Changes in Tax Rules

Tax rules change regularly, and many self-employed people rely on outdated information. This can result in incorrect calculations or missed reporting requirements.

Final Thoughts

These mistakes are extremely common across all types of self-employment, from freelancers and contractors to tradespeople and landlords. Understanding where things often go wrong helps explain why so many people face unexpected tax issues each year.

📞 Call 0161 710 1901

📧 Tax@TaxesDoneRight.co.uk

DM US:

Taxes Done Right