What HMRC Considers “Trading” vs a Hobby for Self-Assessment

January 26, 2026

What “Payments on Account” Really Mean – and When You Can Reduce Them

January 28, 2026If you own property in the UK and receive rental income, HMRC has more visibility than many landlords realise. One of the most powerful tools HMRC uses is Land Registry data, which it cross-checks against tax returns to identify undeclared or under-declared property income.

Understanding how this works can help you stay compliant and avoid unexpected HMRC enquiries.

What Is the Land Registry and What Data Does It Hold?

HM Land Registry records details of property ownership in England and Wales, including:

- Property address

- Purchase price and date

- Names of legal owners

- Type of ownership (freehold or leasehold)

- Transfer history

This information is publicly available and routinely accessed by HMRC.

How HMRC Uses Land Registry Data

HMRC uses Land Registry data as part of its Connect system, a sophisticated data-matching platform that cross-references information from multiple sources.

Land Registry data is matched against:

Let Property Campaign disclosures

Letting agent reports

If HMRC sees that you own a property but have not declared rental income, it raises a red flag.

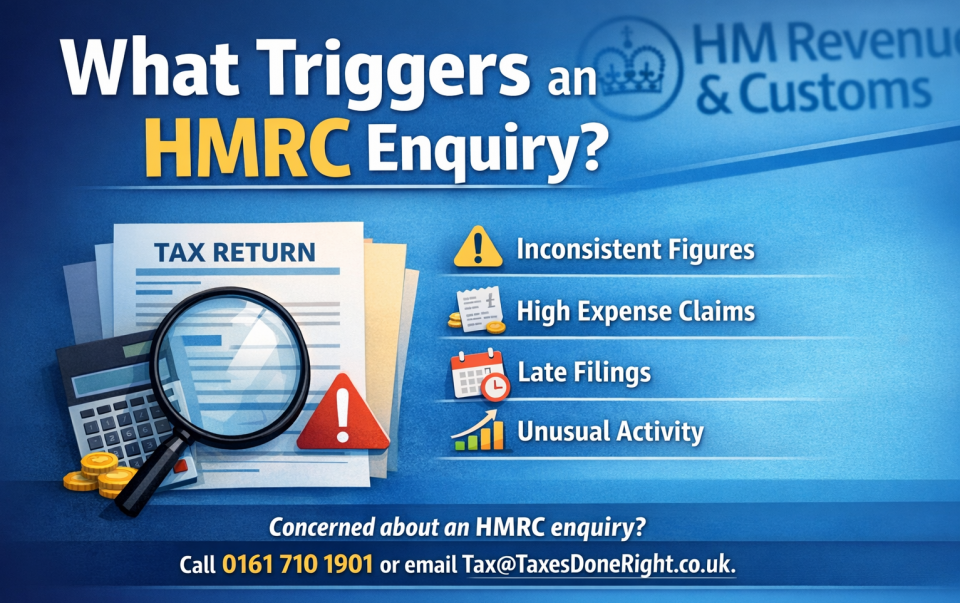

Common Triggers for HMRC Enquiries

HMRC may open an enquiry where:

- A property is owned but no rental income is declared

- Rental income appears unusually low for the area

- A buy-to-let mortgage exists but no property income is shown

- Multiple properties are owned with inconsistent reporting

- A property was previously rented but income suddenly stops

- SDLT records suggest an investment purchase, not a main residence

HMRC does not need proof of rent first. The existence of ownership is often enough to start asking questions.

What About Jointly Owned Properties?

HMRC also checks:

- Joint owners listed at the Land Registry

- Whether income is split correctly on tax returns

- Whether a valid Form 17 exists for unequal ownership

If one owner declares income and the other does not, HMRC may challenge both parties.

How This Affects Limited Companies and SPVs

For properties owned via a company or SPV:

- HMRC matches Land Registry ownership to Companies House records

- Corporation tax returns are reviewed for rental income

- Director loan accounts and dividends are scrutinised

- Missing income can lead to corporation tax, interest, and penalties

HMRC is particularly focused on property SPVs due to historic under-reporting.

What Happens If HMRC Finds a Mismatch?

If HMRC identifies a mismatch, they may:

- Send a “nudge” or compliance letter

- Request explanations or supporting evidence

- Open a formal enquiry

- Raise assessments for unpaid tax

- Apply penalties and interest

Penalties can be reduced significantly if errors are corrected before HMRC contacts you.

How to Protect Yourself

To stay compliant:

- Ensure all rental income is declared every year

- Declare income even if the property was vacant part of the year

- Keep records of expenses, mortgage interest, and repairs

- Review ownership splits regularly

- Correct historic errors voluntarily if needed

If income was missed in previous years, HMRC’s Let Property Campaign can allow disclosure with reduced penalties.

Final Thoughts

HMRC’s use of Land Registry data means “flying under the radar” is no longer realistic. Property ownership is visible, traceable, and increasingly automated within HMRC systems.

Getting your property tax position right is not just about compliance — it’s about peace of mind.

Need help reviewing your property income or correcting past returns?

📞 Call 0161 710 1901

📧 Email Tax@TaxesDoneRight.co.uk

DM US:

TaxesDoneRight