S455 Charge on Director’s Loan Accounts to Increase in Line with Higher Rate Dividend Tax

December 26, 2025

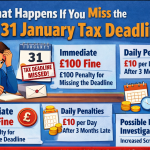

What happens if you miss the 31 January tax deadline?

December 30, 2025As we head into 2026, many UK landlords are asking a big question: Is it still sensible to hold buy-to-let property in your own name? The answer isn’t one-size-fits-all, but recent tax changes and evolving market conditions mean the right structure today may not be what it was 10 years ago.

What’s Changed for Landlords?

In the last few years the UK tax landscape has shifted significantly:

1. Higher tax costs for personally held rental income

Personal ownership means rental profits are taxed at your marginal income tax rate — up to 45% for higher earners. Since interest relief restrictions were introduced, mortgage interest and finance costs no longer get fully deducted against rental income. This has reduced profitability for many personally owned landlords.

2. Corporation tax as an alternative

Holding property via a Limited Company often results in lower effective tax on profits because corporation tax rates are generally lower than higher-rate income tax. Companies can also retain profits for reinvestment at a lower rate.

3. Capital Gains Tax (CGT) on sale

Selling personally owned property attracts higher CGT rates (18%/28%) for residential investment disposals. Companies pay corporation tax on gains, and while extracting cash later can trigger further tax, there are planning opportunities to mitigate the overall burden.

4.Inheritance Tax (IHT) planning

Personally owned property forms part of your estate for IHT. Some corporate structures and trusts can provide more flexibility for succession planning — though these require professional advice and can carry their own tax consequences.

Pros and Cons: Personal vs Company Ownership

| Personally Owned | Company Owned |

|---|---|

| Simpler to manage and report | Potentially lower tax on profits |

| Direct access to rental income | Profits trapped unless extracted (dividends/salary) |

| Mortgage access often easier | More admin and regulatory requirements |

| No corporation tax filings | Different CGT profile on sale |

When Personal Ownership Might Still Make Sense

✔ You are a basic-rate taxpayer with modest rental profits

✔ You plan to sell soon and want Entrepreneurs’ Relief (now Business Asset Disposal Relief) conditions

✔ You value simplicity over long-term tax optimisation

✔ You’re not scaling a portfolio

When a Company Structure Could Be Better

✔ You’re a higher-rate taxpayer

✔ You want to retain profits for further investment

✔ You’re building a larger portfolio

✔ Succession planning / inheritance tax mitigation is a priority

Practical Steps for 2026

Review your current holdings — run the numbers comparing tax under personal vs company ownership. Changes in personal tax bands, corporation tax rates, and reliefs mean modelling scenarios can uncover meaningful differences.

Consider refinancing before moving properties into a company — transferring titles can trigger SDLT and CGT.

Plan ahead — tax regimes keep evolving. What’s optimal today might shift with future budgets.

Need Help Deciding?

Deciding whether to hold property personally or through a company in 2026 depends on your finances, goals, and tax position. If you’d like tailored guidance or a personalised comparison, get in touch: